Why integration of regulatory compliance is must in a business

Some Entrepreneurs, Solopreneurs are least interested in abiding by rules and integrating regulatory compliance. This is what differentiates success and failure. Research says, “ When it comes to running a business, about 80% make it through their first year. This percentage tends to gradually reduce as the years go by. Only 70% survive their second year, and by the tenth year, only about 30% remain in business”.

Running a business relies on a number of factors. Missing any of these factors heavily impact the survivalist of business in the long run. Before we dive into this fact, for an amateur, let us start with first thing first-

What is regulatory compliance for a business?

Regulatory compliance for a business refers to adherence to business rules and regulations. These rule and regulations are issued by the Government of the country. Besides, there are a set of rules that are formed within the company. Rule and regulation help to run the business and get rid of any legal setbacks.

The set of rules, regulations, and guidelines varies from country to country and industry to industry. For example, a healthcare company needs to follow guidelines that ensure the right uses and storage of the medicines. Healthcare companies have a stock of drugs, vaccines as well as personal data of patients. These companies need to abide by rules to maintain the privacy of patients. Healthcare professionals should abide by HIPAA to prevent data breaches. Patients should be notified in case of any unwanted inconvenience.

Multinational companies adhere to the rules of different countries where they operate. Such as to run a business in Qatar you need to register as LLC (Limited Liability Company) or WLL. Along with this, you will need a commercial Residence or CR, Trade License and Computer card. On the other hand, to run a commerce business in India, you need to go through The Indian Contract Act, 1872-I; The Indian Contract Act, 1872-II, The sale of goods Act, 1930; The Indian Partnership Act, 1932; The Limited Liability Partnership Act, 2008; and Companies Act, 2013.

Why Integration of regulatory compliance is must in a business?

Regulatory compliance guides business through complex legal formalities and paves way for faster business growth. An organization need to be organized and well- structured to meet up to the changing legal requirement of the era. With time, legal needs and complexities have increased. Non-compliance sometimes leads to a huge amount of financial loss in the form of fines, Interest and Penalties.

Another major reason to integrate regulatory compliance in a business is to ensure a smooth cash flow.

A study says, “82% of business failures are due to poor cash management”.

Business owners usually get carried away in core business development and legal necessities are left behind. This in the long run leads to poor cash management and therefore the business collapses.

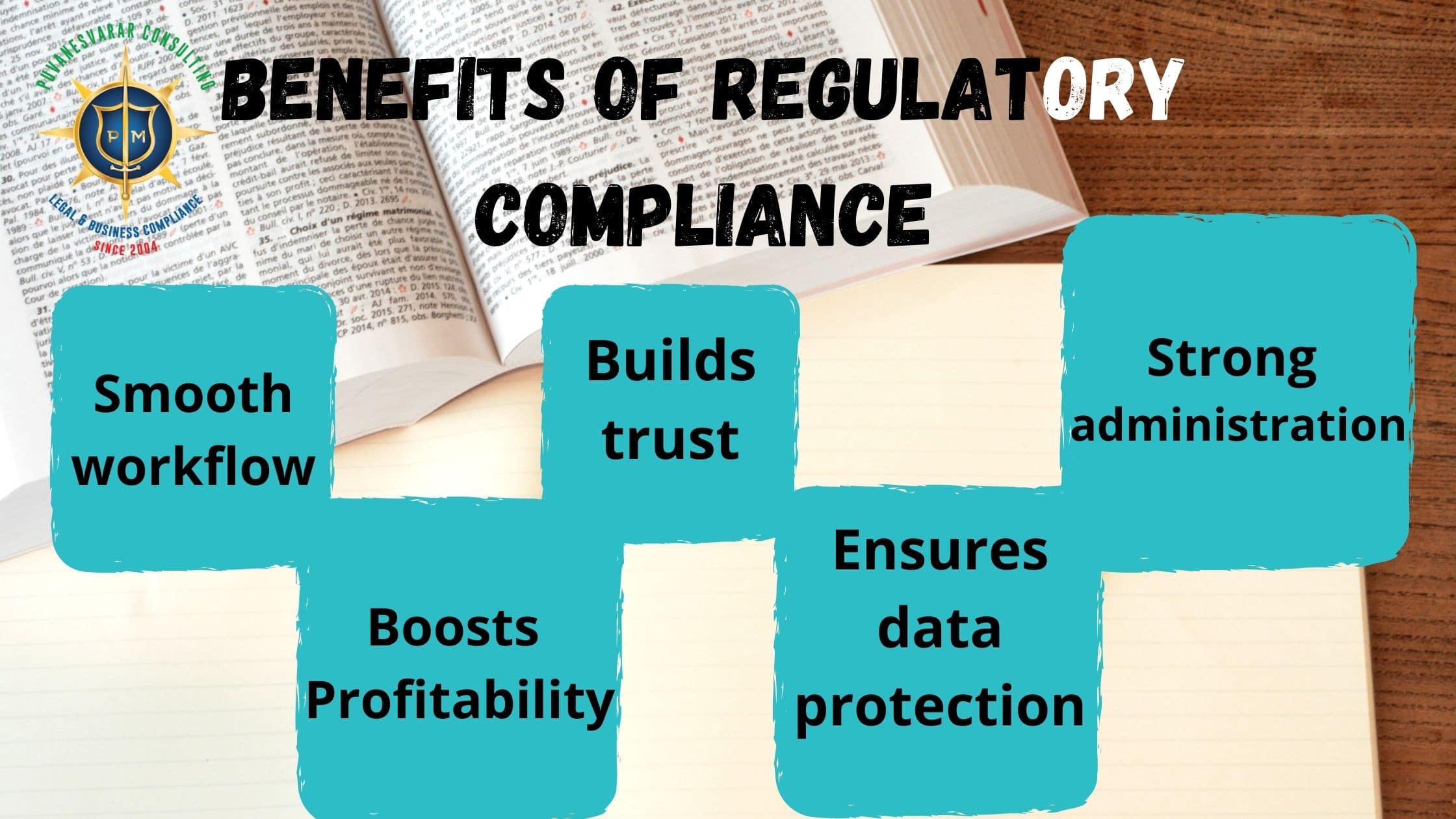

Benefits of Integrating Regulatory compliance in a business:

Smooth workflow:

Most businesses are not able to survive after a decade. This is due to improper workflow and financial imbalance. The organized and hassle-free workflow prevents any financial losses. Integration of regulatory compliance assures smooth cash flow.

Strong administration:

It helps to stick to industry-specific regulations and laws issued by Government. As the business expands, the need for compliance increases. It is difficult to manage a big workforce without setting rules and regulation. Compliance makes sure these rules and regulations are implemented and followed by the workforce. Employees are aware of the repercussions of not following business rules and hence are more mindful and aware of their responsibilities while doing their tasks.

Builds trust:

The Trust of customers is of utmost importance for the success of the business. A business that adheres to rules and regulations are more trustworthy in the eyes of customer than non-compliant business. Integration of Regulatory compliance in business leads to increased trust among customers. The Government certification gives you an edge to stand strong and above the crowd. You can take advantage of the perks such as credit cards because of meeting legal qualification.

Boosts profitability:

Trust is directly proportional to a boost in profitability. Integration of compliance changes potential customers to loyal customers. This further boost sale of product or services and henceforth accelerates profitability. We are living in a digitalized era and with the pandemic, the dependency has increased exponentially. Words of appreciation and shares on social media platforms further spike the revenue. Customers love to share their positive experiences with their peers which ultimately strengthens marketing.

Ensures data protection:

A data breach is a rising concern in this digitalized era. Customers are worried about data loss and hence hesitate to go for purchase from the non-compliant business. A business that follows compliance has a strict code for workers which decreases the probability of data breach. You can tell your customers how much you care about them and have gone the extra mile to make sure their data is safe.

A quick glance:

Rules and regulations are part and partial of business operation. The government keeps changing the regulations with changing era. A business striving to hit business goals should keep up with the rules and regulations. The compliance need of business depends on the types of business and the country of operation.

Being a business owner at times it is difficult to keep a 360-degree look on all aspect of the business. You need to closely monitor the regulatory need of your business. To ensure a smooth flow you can take the help of Puvanesvarar Mailvaganam. While he takes care of the legal necessities of business, you can take care of core business development. Your undivided attention and apt implementation of compliance will lead to business growth by leaps and bounds. He has worked with top brands like Mc Donalds, Qatar petroleum, Burger King, Certis, etc. He says, his years of experience and proven structure is a valuable asset for business growth.

Integration of compliance keeps brand image safe. A delighted customer leads to a successful business.